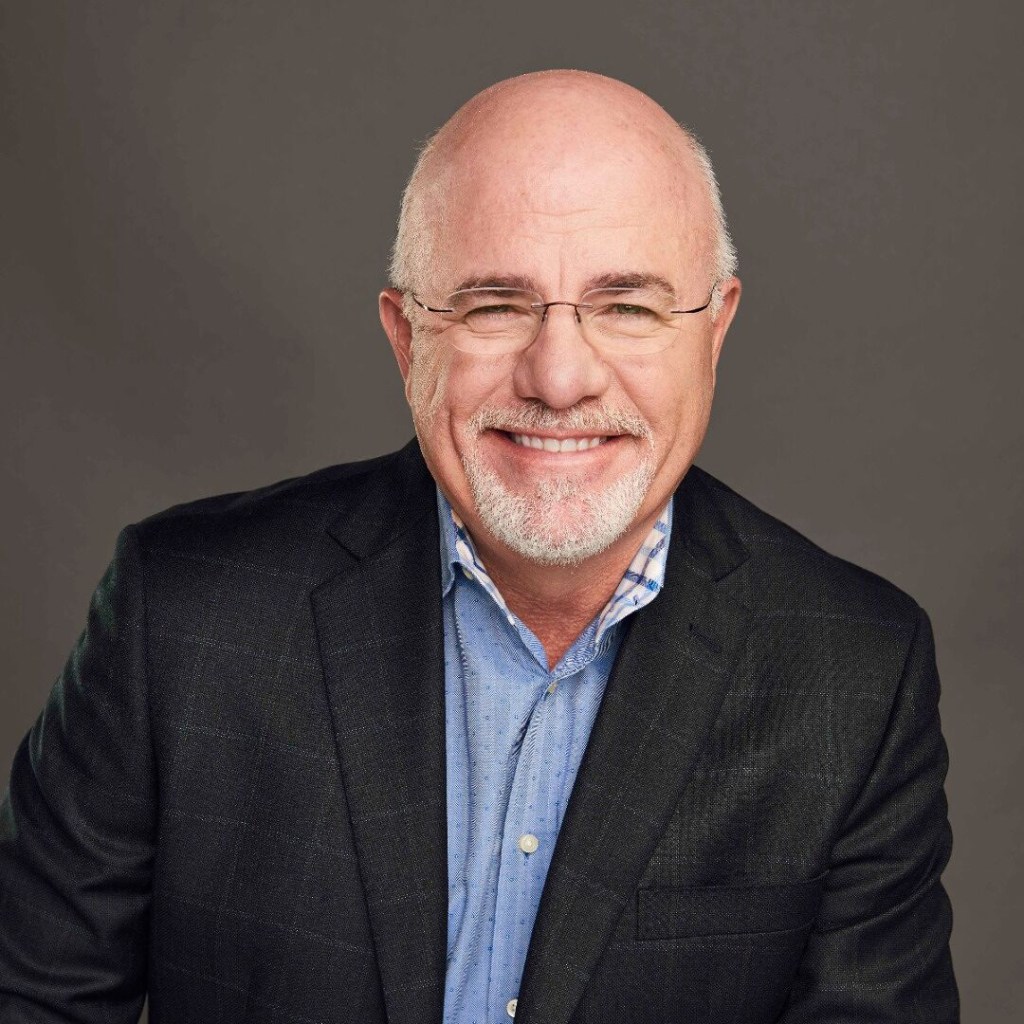

Dave Says: Find an advisor with the heart of a teacher

Published 2:30 pm Friday, July 21, 2023

|

Getting your Trinity Audio player ready...

|

By Dave Ramsey

Syndicated Columnist

Dear Dave,

Trending

I’m a widow, and I retired recently. My husband took care of most of our finances. We never had any debt, but after my husband died and I started learning a little bit more about how money works, I’m concerned too much of it may be invested in CDs. The total nest egg is a little over $1.5 million, with $300,000 of that in CDs. There’s also a $317,000 annuity, a 403(b) and around $900,000 in IRA mutual funds. I want to learn even more about financial matters, so how do you think I should handle things going forward?

— Naomi

Dear Naomi,

Well, the CDs (Certificates of Deposit) give you stability, if nothing else. They’re generally considered a safe, low-risk investment, but they don’t really give you the best bang for your bucks. If you’ve had good luck with a variable annuity, that’s fine, too. It sounds like you’ve also been very fortunate with your mutual fund investing. So, with all this money in different areas, you’re definitely diversified.

In my mind, it’s just a matter now of wrapping your arms around it all and developing a deeper understanding of things going forward. I’d urge you to find an investment professional in your area with the heart of a teacher. I’m talking about someone who wants to help people, and is interested in more than just making money off fees or commissions.

It sounds like you understand the value of learning about this stuff, and I’m really impressed by that. It’s a smart and necessary thing. From here on out, every time you see an investment person—whoever it may be—your goal should be to leave the room smarter, and with more financial understanding, than you had before.

Trending

Naomi, I’m truly sorry about your husband. But you two did an amazing job with your finances over the years. You’re worth well over $1.5 million, and you have no debt. So, you’re basically set for life.

Be wise, and be careful, Naomi. God bless you.

— Dave