Auditor: County needs to repay $93K to County Attorney’s Office

Published 2:55 pm Thursday, May 28, 2020

|

Getting your Trinity Audio player ready...

|

The state auditor said Clark County should return $93,000 to the County Attorney’s Office and questioned another $8,775 in bonuses to county attorney staff members.

The statements were part of a recent report surveying financial operations, internal controls and processes in nine Kentucky county attorney offices by Auditor of Public Accounts Mike Harmon.

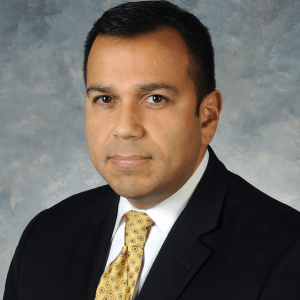

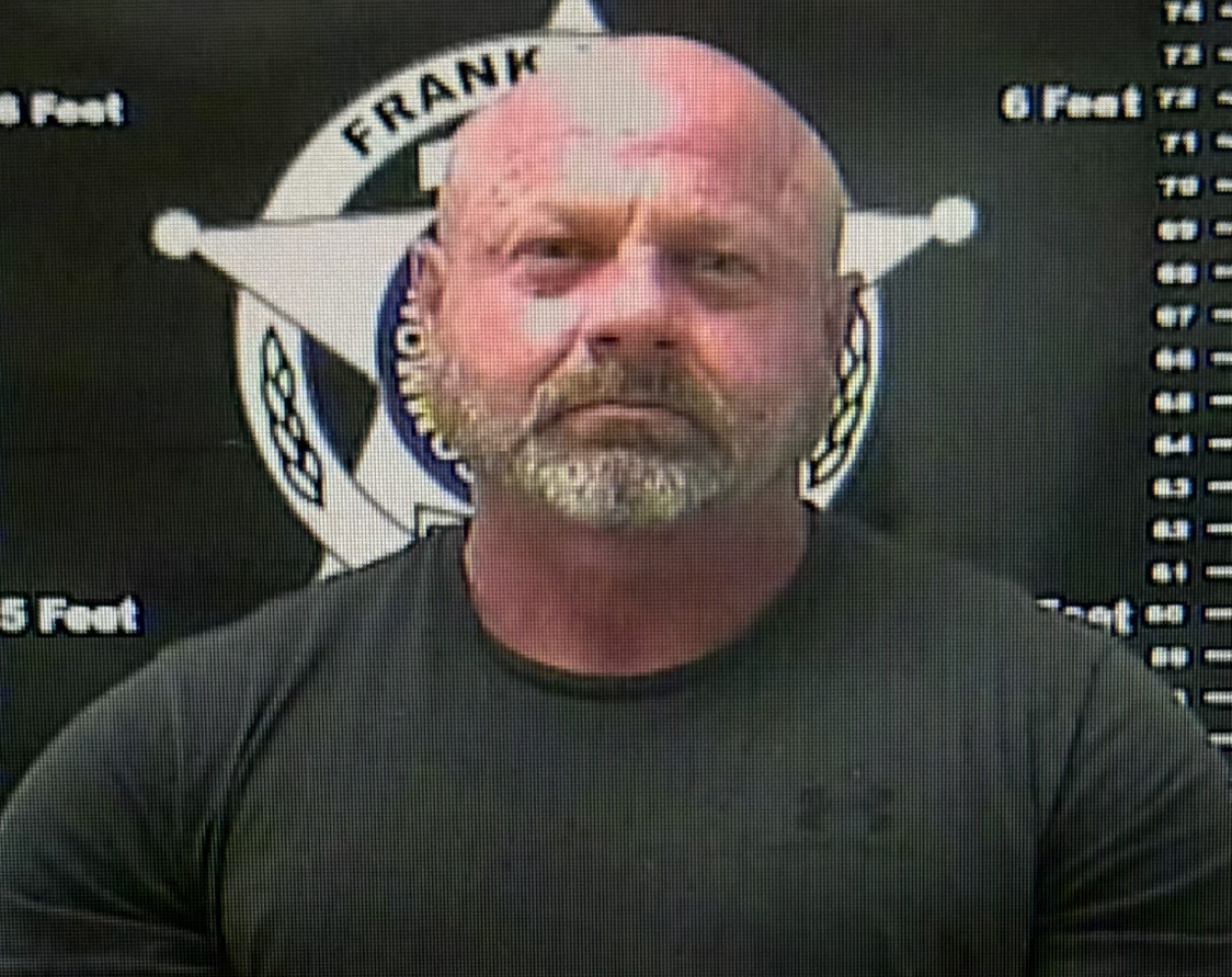

The report cited three issues in Clark County: a $8,775 payment from Clark County Attorney William Elkins to office staff without supporting evidence of work performed or basis for payments, nearly $200,000 in transfers by former County Attorney Brian Thomas to the Clark County Fiscal Court between Dec. 12, 2018, and Jan. 7, 2019, and $93,500 in delinquent tax funds transferred to the Fiscal Court from delinquent tax funds between Aug. 14, 2017, and Aug. 16, 2018.

Trending

In all, the report said, Thomas transferred $292,229 from Aug. 14, 2017, through Jan. 7, 2019, his last day in office, from the county attorney funds to the Fiscal Court for a number of projects. The bulk of those funds, $198,729, occurred right before Thomas left office.

Thomas said those transfers were required under state statute before he left office. His two predecessors as county attorney, he said, turned over approximately $160,000 each to the Fiscal Court.

“When I left office, I did the exact same,” Thomas said.

Of the total, only $8,422 were from cold check collection fees, which are the only ones required to be turned over to the Fiscal Court.

Harmon recommended the Fiscal Court return $93,500, which was transferred from delinquent tax funds between Aug. 14, 2017, and Aug. 16, 2018, to the County Attorney’s Office. Some of those transfers were for HVAC repairs at the Clark County Detention Center and to purchase equipment for a brush truck for the Clark County Fire Department.

A statute requires delinquent tax funds only be used for operating expenses of the County Attorney’s Office, according to the report.

Trending

Thomas said the $93,500 was used to pay the salaries of his staff.

“The monies that were given to the Fiscal Court were earmarked as income,” he said. “The problem is you see $93,000 going to the Fiscal Court, but (auditors) didn’t talk to the Fiscal Court about the cost of operating the County Attorney’s Office.”

Harmon said the Clark County Fiscal Court should seek an opinion from the attorney general about handling the funds paid by Thomas to the county. He also said he would seek legislation in 2021 to establish a process to settle funds when the county attorney is leaving office and how those funds should be used.

Harmon said the $8,775 payment to staff members amounted to a one-time bonus, which is “generally prohibited” from public funds. Harmon’s staff found similar issues in six other counties in the survey.

“In each of these instances, the funds used were public funds, and no documentation existed to associate these payments with work performance,” the report reads.

In his attached response, Elkins said the expense was “prolifically documented” and “obviously” related to public service. He said the county attorney’s staff had not received a salary increase in two years, and his employees still needed to “present themselves professionally” and in “proper attire meeting with the dignities of the court.”

Elkins also said a clothing allowance was not listed among prohibited uses for fees generated by the office, and there was plenty of documentation for the allowance.

Elkins wrote that “to treat the expense as a bonus is an unfair characterization regarding employees who had been left in the cold to feel the compounding effect of missed raises in their ability to dress for work or retire while engaged in purely public service.”